What

A customized multi-week course that supports participants in creating a culture of savings, understanding systemic barriers to building wealth, and connecting to equitable resources within the community to support their financial wellbeing.

Why

We know that in our community, many obstacles and injustices exist, especially for communities of color, preventing people from sustaining themselves and their families. The data shows: 40% of Coloradans cannot pay for an unexpected $400 expense without borrowing or selling possessions (Federal Reserve Board 2018); in the Denver Metro area, over 20% of households are either unbanked or underbanked, leading to unnecessary fees and abuses (FDIC National Survey 2015); 27% of Colorado households currently fall below the self-sufficiency standard, meaning they lack sufficient funds to cover necessities such as food, shelter, health care, and child care (Colorado Center on Law and Policy 2018); Race plays a critical role in economic injustice. In 2016, white family wealth was seven times greater than black family wealth, and five times greater than Hispanic family wealth. People of color are less likely to own homes, have more student debt, and have six times less liquid retirement savings than white people (Urban Institute 2017).

Philanthropiece is working to address these issues through participating in systems and institutional level policy work and by working alongside local organizations to positively shift people’s day to day lives.

Who

Philanthropiece engages in a participatory process to design and continuously iterate the Financial Health Course collaboration with past and current program participants and Cultural Brokers, with special recognition to: the teams and clients of EFAA, OUR Center, Sister Carmen, Boulder Housing Partners, I Have a Dream, Boulder County Workforce and Personal Financial Coaches, Bridging Digital Divides, and KIVA. With much gratitude to Ricardo Cabrera, Mayra Zavala, and Ingrid Castro-Campos for sharing their expertise and experience with us to develop this work.

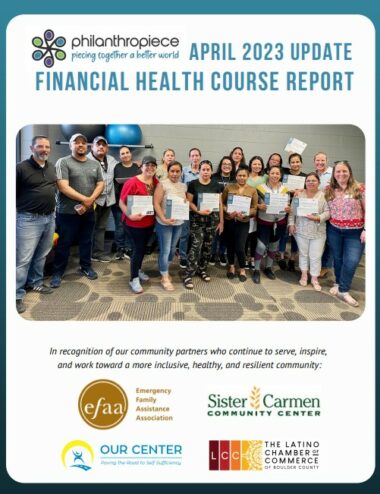

In partnership with:

- Boulder Housing Partners

- Emergency Family Assistance Association (EFAA)

- I Have A Dream Foundation of Boulder County

- OUR Center

- Sister Carmen Community Center

- Bank On Boulder

- Bell Policy Institute

- Various financial institutions throughout Boulder County

With special recognition to Alpine Bank and Key Bank for their efforts to create access to fair and equitable financial products for all community members and for their generous contribution in support of the Financial Health Course.