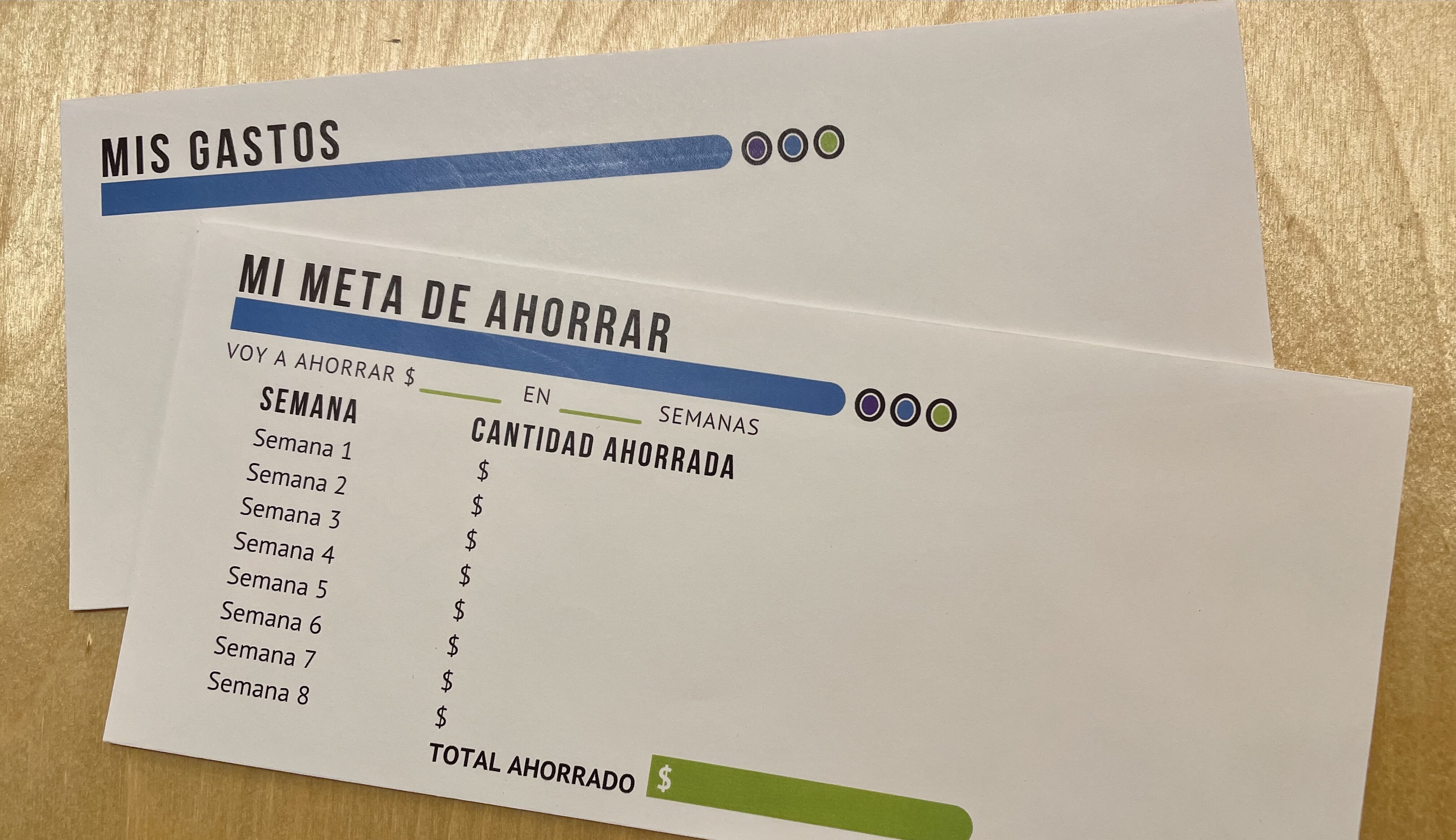

Two envelopes. One devoted to expenses and one devoted to savings. On the back of the savings envelope, a person writes down their personal and financial goals. On the back of the expenses envelope, a person writes down their personal and family values. It’s a simple concept, one presented to participants of Philanthropiece’s pilot 8-Week Financial Wellness Course. Although simple, it has proven to be effective in motivating people to start savings.

The idea of the two envelopes, along with broader concepts around a personal culture of savings, systemic barriers and resources within existing financial structures, financial mental health and other financial literacy ideas, are presented during the Financial Wellness Course pilot.

“I love the folder they gave us with all the classes. It has two envelopes. One envelope is where we can put the money we are saving and the other is where we can save our receipts for money that we are spending. By doing that, it is providing me a tool. I feel like I want to put money in there, instead of going out and wasting money, spending money on something I don’t really need, I want to put like $20 in that little envelope. Then I know if anything comes up, I will have something to go to and help me until I get paid. I don’t want to live paycheck to paycheck anymore,” says Jessica Alvarado, a participant in the Financial Wellness Course pilot.

The idea of the two envelopes, along with broader concepts around a personal culture of savings, systemic barriers and resources within existing financial structures, financial mental health and other financial literacy ideas, are presented during the Financial Wellness Course pilot. The idea of the course and the content within the course is a result of Philanthropiece’s efforts to address issues of economic justice within our local community. The creation of the course draws on years of work with community savings groups in Mexico and local community engagement in Boulder County. This engagement has included understanding the unique economic and financial needs of Boulder County residents.

“We know that there are really good resources in the community around economic justice or stability or finances,” explains Jordan Bailey, Philanthropiece’s Economic Justice Program Manager.

“But we just felt like there was a little bit of a gap. Some people are using those services and it’s great but others have never heard of those resources or are not using them. Why? We started to dig a little bit and there were some limitations,” continues Jordan.

Philanthropiece’s work around local economic justice issues also included building relationships with other non profit organizations working within the realm of financial independence and education.

One of the key collaborations that helped Philanthropiece in the creation of the pilot course has been with Emergency Family Assistance Association (EFAA). Prior to 2020, Jordan was visiting local non profit groups to share the work Philanthropiece was doing around economic justice in Boulder County. During one of these visits, Jordan visited EFAA’s Participant Advisory Committee (PAC).

This approach, of listening and being guided by community members who are most affected by economic justice issues, served as a common thread that wove through both organizations.

“Jordan had come when we were still meeting in person at EFAA, to do a presentation on Philanthropiece. There was a lot of interest in financial literacy, savings, all those things, which came directly from our PAC,” explains Marnie Copeland, who was serving in the role of Children, Youth and Family Program Manager, as well as Community Enrichment department head, during the development of the Financial Wellness Course pilot.

“The collaboration [with Philanthropiece] was born out of one of our core values of listening to our participants and not just having this top-down model,” says Marnie Copeland.

This approach, of listening and being guided by community members who are most affected by economic justice issues, served as a common thread that wove through both organizations. After Jordan’s visit to EFAA, a relationship was built between Marnie Copeland and Philanthropiece staff and the idea of the Financial Wellness Course pilot began to take shape. They collaborated on the concept and overall layout of the course, as well as the idea that EFAA would recruit members of its community to be participants in the first pilot launch. Philanthropiece contributed much of the content, which was a combination of lessons learned from our work in Mexico and through courses Jordan was taking around financial education and economics.

“I took a course through the Financial Health Institute in early 2020. There was another course I took through Hispanic Wealth [Project]. I have been taking courses from Change Machine, which is an online platform for case managers, coaches, things of that nature. I am not a financial coach but I was getting a lot of information. And we were starting to see a different way to approach behavioral economics,” says Jordan.

These insights helped to hone the pilot course with EFAA into an 8-week long structure, in which participants engaged in weekly 90-minute sessions. These sessions provided six weeks of predetermined course material, with opportunities for participant feedback and input. The sessions often featured local speakers and experts presenting on topics relevant for that week’s material and learning objectives. Week six and seven were open sessions in which participants in the group got to select additional areas they wanted to learn about, such as housing and financing, credit scores, building businesses and investing.

A main objective of the course is to have participants come away with their own personal “savings culture”. This is done largely through the individualized approach presented in the course, where participants get to determine their own savings objectives, their personal values around money and lifestyle, and their long-term financial goals.

“Our overall objective in this multi-week course is that people are making changes in their lives because of this course, based off of the needs that they have presented to themselves and us. We also have built very tangible goals, we want to make sure folks have savings. And we want to make sure they have the resources to reach those goals. One of the things that I am really, really excited about is that people actually did something during the course, it is not just education. Here are some tools behind the education, here are some resources,” says Jordan.

To reach more people in the community, Philanthropiece is working with several other local non profit organizations, offering the course pilot for members of their networks. There are courses currently scheduled with Sister Carmen Community Center and OUR Center in Longmont. Marnie Copeland, with EFAA, sees the broader potential of the pilot.

“I think this could be a model program. If we do it right, with the right data and evaluation and metrics and we show that we are making an impact, to me this could be a model program countywide,” says Marnie.

As part of the pilot, Philanthropiece will continue to follow up with participants after six-months of attending the program. It is an opportunity to see how they have utilized the education and tools in the program. It is also an opportunity to see how the ideas within the course may have resonated with them.

“I have been thinking about saving for a vacation, not just running after bills and things like that. I want to also think about something that could make our hearts happy,” say Jessica Alvarado.

Morning Glory Farr is Philanthropiece Foundation’s Content Manager and Editor. She is passionate about sustainable living, resource conservation, and bringing a deep curiosity to her work, life and relationships.