For those of us living in the developed world, it is easy to take for granted our access to banking and financial opportunities. Even in our current economic state of large banks putting profits before customers and the economic turmoil we face as a nation, as customers in the United States we have a great advantage over much of the world – choice. Rural communities across the globe don’t have access to choices, if they have access to any form of traditional banking. This gap is where Philanthropiece aims to work alongside communities, developing forms of banking to create financial sustainability where there is none.

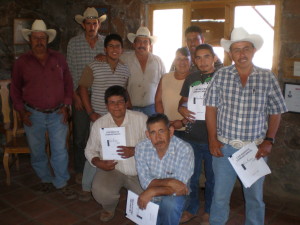

Community Banks tend to be the only form of savings that rural communities have in Baja. These small and isolated towns are able to serve their own financial needs through the community banking programs started by Philanthropiece. On a base level, the concept of Community Banking in Baja is simple; a small group of community members meet on a weekly basis to collect their saved earnings into a community bank box, and after one month of collecting savings, they can petition the community for a loan from the joint savings bank. Loans are approved by community consensus and are often used to fund small business and other community-minded enterprises. They then create guidelines to determine interest rates over a determined period of time. Loans are taken carefully and are faithfully repaid on time.

Community Banks tend to be the only form of savings that rural communities have in Baja. These small and isolated towns are able to serve their own financial needs through the community banking programs started by Philanthropiece. On a base level, the concept of Community Banking in Baja is simple; a small group of community members meet on a weekly basis to collect their saved earnings into a community bank box, and after one month of collecting savings, they can petition the community for a loan from the joint savings bank. Loans are approved by community consensus and are often used to fund small business and other community-minded enterprises. They then create guidelines to determine interest rates over a determined period of time. Loans are taken carefully and are faithfully repaid on time.

While the intention is to provide an innovative and effective savings and loan program, benefits extend beyond poverty alleviation to include other benefits such as leadership development and community cohesion. Philanthropiece believes that by creating Community Banks, communities can become more unified and empowered to continue managing the banks on their own, with an infrastructure in place aimed at long-term sustainability. This is an extremely important component to community development. Once the communities have received the tools of the Community Banks and successfully implement them, Philanthropiece can ultimately withdraw from our active role and recede into the background as advisors and supporters. This allows our partner communities in Baja to take charge of their own financial futures.